6 min read

Should employers acknowledge Blue Monday?

Blue Monday (15 January) has a mixed reputation. But there’s still value in using the day to raise awareness of mental health and wellbeing...

2 min read

Galina Stavskaya-Barengo, CFA

06-35-2023

Galina Stavskaya-Barengo, CFA

06-35-2023

If you’re a financial services firm, you’ve probably heard of the FCA's Consumer Duty, which is due to be introduced on 31 July 2023.

It’s a new set of rules from the UK regulatory body, the Financial Conduct Authority (FCA), to ensure customers understand the financial products they are buying and get the support they need, when they need it.

Building on our What Is Consumer Duty? Essential Guide to Readying Your Firm and Keeping Compliant article, here we break it down further and explore how firms can support and empower their customers under the FCA Consumer Duty.

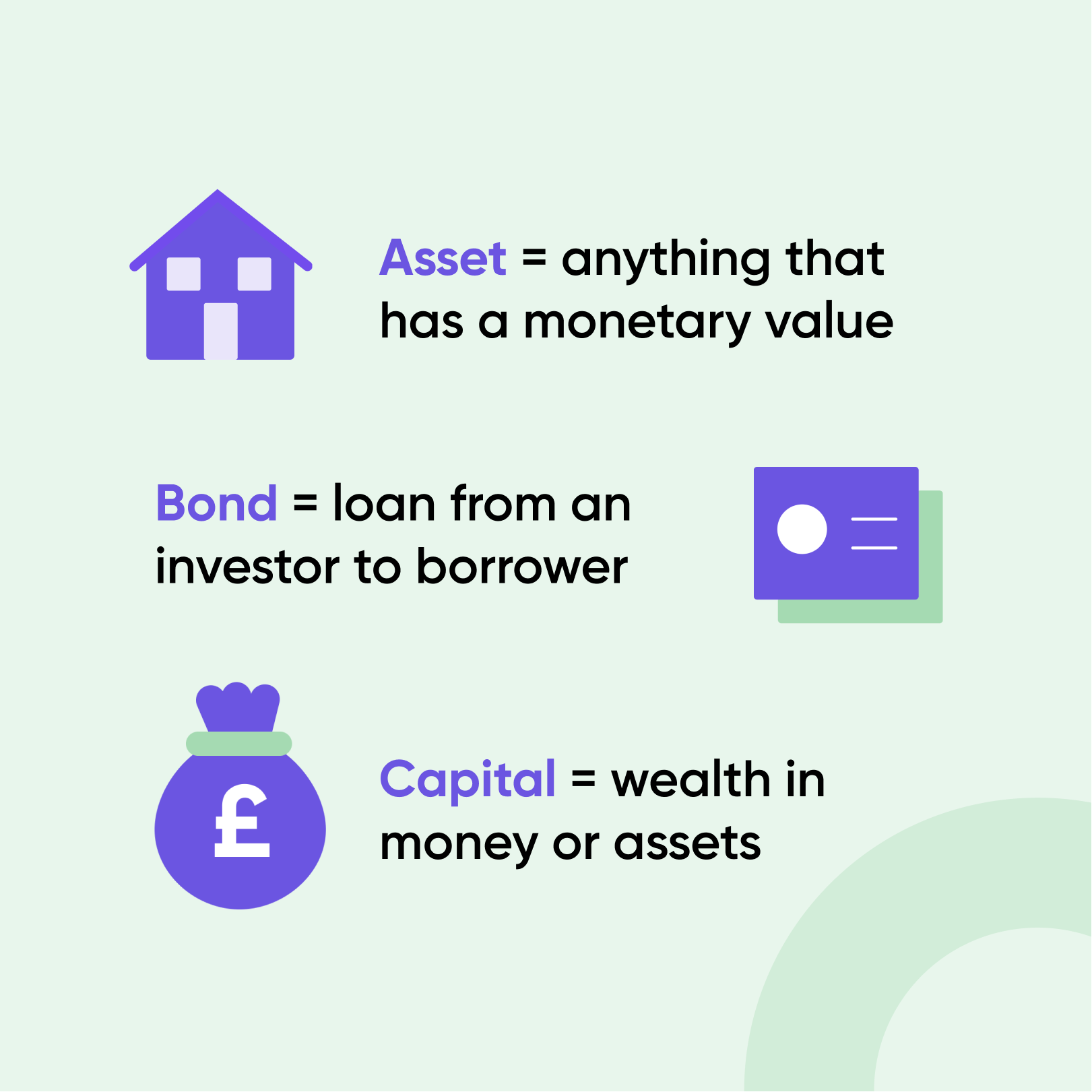

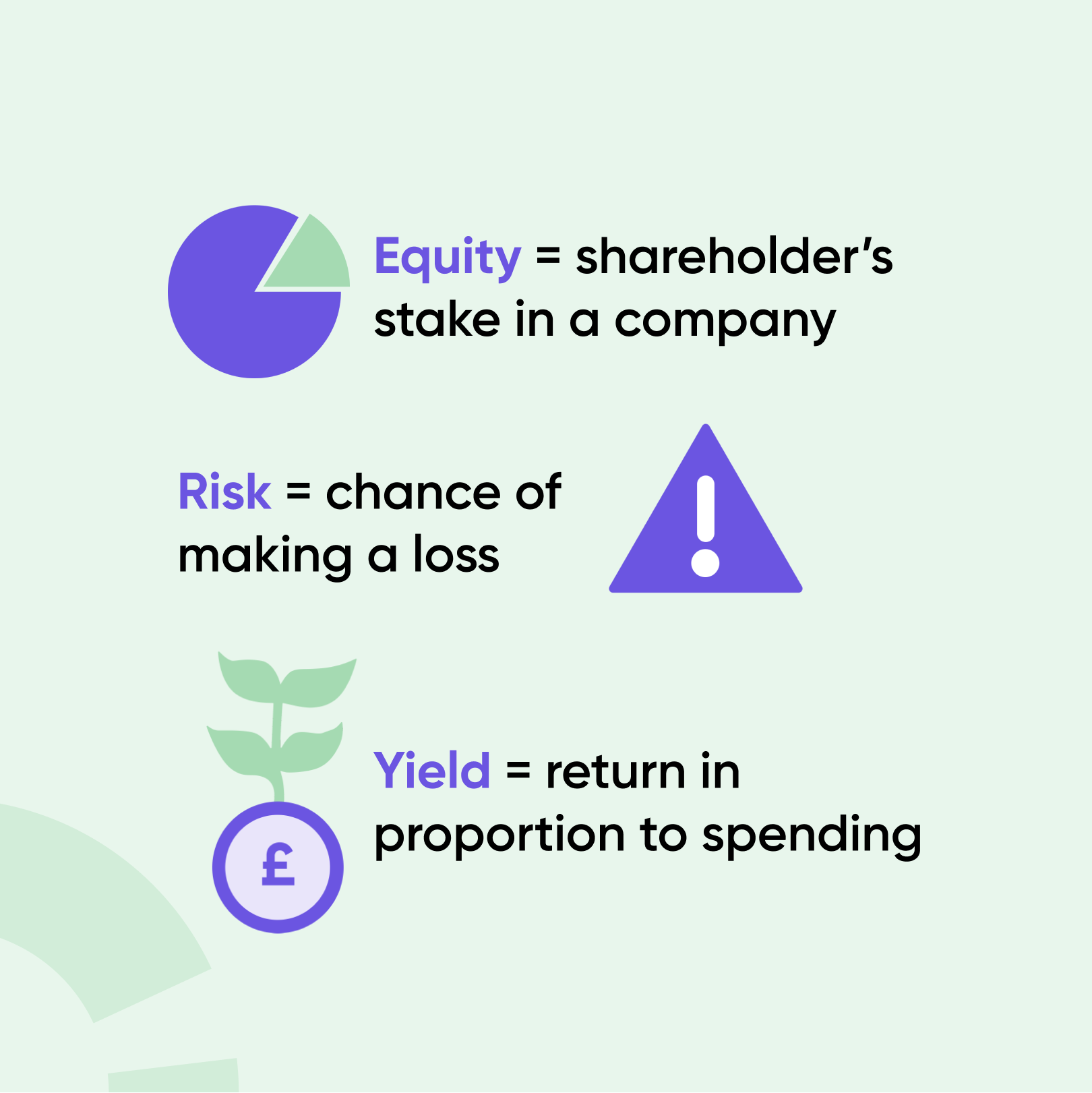

Organisations can support their customers by providing information in a way that is clear and easy to understand.

This means avoiding technical language or jargon and using language that is appropriate for the customer's level of knowledge.

You should also provide customers with clear information about costs, risks, benefits, and any terms and conditions that apply, so that they can make informed decisions.

Companies can empower their customers by taking into account their financial circumstances, goals, and risk appetite, and offering solutions that are appropriate for them. In addition, they can provide customers with information and tools that help them to make informed decisions about which products and services are right for them.

Another way to empower customers is to provide suitable recommendations to their customers, based on their needs and circumstances, so they can make the right decisions. This means taking into account the customer's investment goals, risk tolerance, and time horizons, and providing advice that is based on their individual needs.

Firms can do this at any stage of the customer journey, regardless of whether the customer has already purchased a product, or is about to purchase a product.

Firms can also explain the risks associated with different investment strategies, and provide customers with information on the likely outcomes of different investment decisions.

Vulnerable customers should be offered additional support and guidance where needed.

This might involve offering alternative communication channels, such as email or text message, providing additional information, or offering a more tailored service. Firms can also take steps to identify vulnerable customers, and ensure that their needs are taken into account when providing products and services.

Organisations should make sure their products and services are suitable for their intended use.

This means regularly reviewing and updating products and services to ensure that they remain relevant and appropriate, and providing customers with clear information on the features and benefits of each.

Firms can empower their customers by ensuring that they have effective complaints handling procedures in place, and that they respond promptly and fairly to any customer complaints.

This means providing clear information on how to make a complaint, offering a range of communication channels, and resolving complaints in a timely and efficient manner. Firms can also use customer complaints as a way to improve their products and services, by identifying areas where improvements can be made.

Contact Galina Stavskaya CFA, head of partnerships at Claro Wellbeing, to find out how we can help support your business’s needs.

The FCA & Financial Ombudsman Service (FOS) has published several documents about the Consumer Duty, including a policy statement, consultation papers, and guidance. See below:

|

Is your firm ready for 31 July 2023?Arrange a call with Claro Wellbeing to discover how we can help fast-track your firm's preparations for the FCA's Consumer Duty. |

6 min read

Blue Monday (15 January) has a mixed reputation. But there’s still value in using the day to raise awareness of mental health and wellbeing...

4 min read

Ever wished you had a money-whiz friend you could ask anything, as often as you like?

7 min read

Millions are being impacted by financial stress. Yet, until now, workers in frontline occupations have not been able to benefit from educational...