6 min read

Should employers acknowledge Blue Monday?

Blue Monday (15 January) has a mixed reputation. But there’s still value in using the day to raise awareness of mental health and wellbeing...

If you lead HR, benefits or rewards at your organisation, these insights will help you plan your financial wellbeing strategy and move your people forwards.

Inflation is putting pressure on every household in the UK and worldwide. It’s leading to unavoidable rises in household spending while wages remain the same.

As a result, many HR, benefits and rewards specialists are focusing on financial wellbeing, creating strategies to ensure their employees’ financial health is supported and financial stress is minimised.

We surveyed more than 1,300 UK workers to understand how they are coping financially. We published a wider selection of results in The Workplace Today, along with insight to help organisations support their staff.

Our survey generated almost 25,000 data points. But some were particularly surprising. So much so that we think every HR department who cares about their staff’s wellbeing should pay attention.

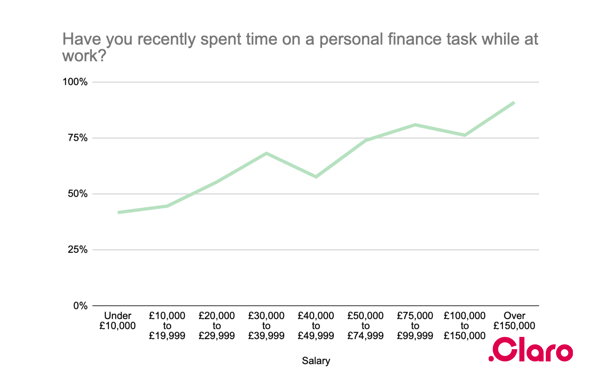

Our data reveal that the more an employee earns, the more likely they’ll spend time on a personal finance task, during office hours.

Those on less than £10,000 are the least likely to manage their personal finances during work hours (42%). While those on over £150,000 are the most likely (90%). On average, 63% of employees say they have worked on personal finances while at work.

Having a financial wellbeing strategy could mean organisations introduce a specific time during the week for their employees to work on personal finance tasks. Employees could, for instance, take part in Finance Friday sessions to tackle money-related tasks, or book a video session with an expert financial coach.

The potential outcome of a financial wellbeing strategy could be different for each employee, depending on their earnings. For example, being given dedicated time to sort out their personal finances more effectively could see the highest paid spend more time on their work.

In turn, through a financial wellbeing strategy, employers would see a large return on investment by helping their highest-paid employees, whose time costs the business the most.

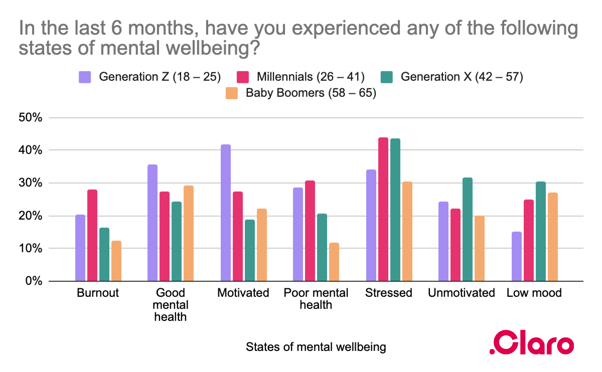

The last six months have seen employees experience different states of mental wellbeing.

While some respondents have indeed experienced good mental health, many also have experienced a range of states associated with negative mental health.

Almost one in three (29%) of Generation Z and 31% of Millennial employees say they have experienced poor mental health, compared to 21% of Generation X and 12% of Baby Boomer employees.

In our original survey, this question gave respondents the ability to choose multiple answers. And, on average, each respondent selected two of the above options.

Money and mental health are intrinsically linked. And when implementing a financial wellbeing strategy, leaders must factor in the dynamic nature of employee mental health.

Our past research has shown that the less financially confident an individual is, the worse their mental wellbeing tends to be. It’s important to view financial wellbeing support as one among many mechanisms that can bolster mental wellbeing.

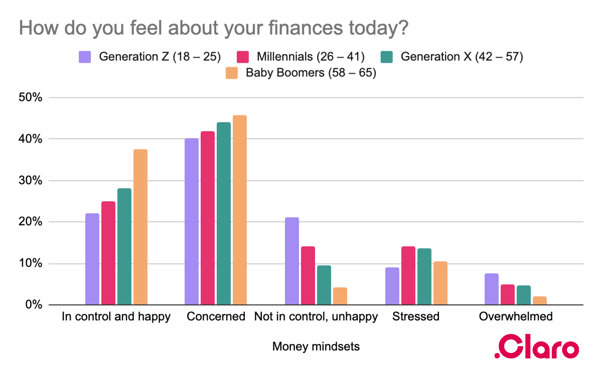

Young people are the most likely to feel like they are not in control or unhappy with their money, according to our data. Indeed, this is the case for 21% of Generation Z employees. While only 4% of Baby Boomers feel the same way.

Only one in five Generation Z employees is likely to feel in control and happy when it comes to money, compared to 25% of Millennial employees, 28% of Generation X and 38% of Baby Boomer employees.

The majority of employees, however, feel at least ‘concerned’ about their finances as the cost of living continues to increase.

The goal of any financial wellbeing strategy is surely to make as many employees as possible feel in control of and happy about their money, no matter their age or stage of life.

But understanding that not all employees feel exactly the same kinds of emotions around their money is an important step in planning the kind of support you should offer company-wide.

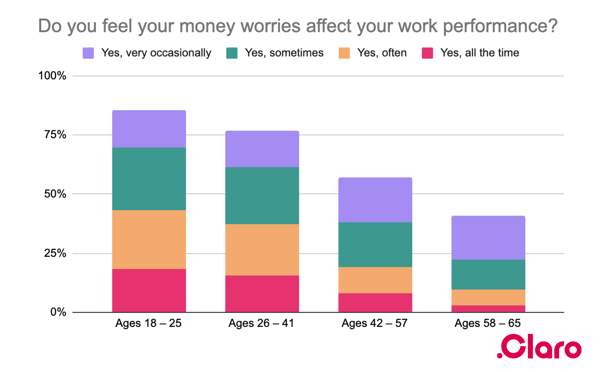

For every Baby Boomer that says money worries affect their work, there are two Generation Z and two Millennial employees that feel the same.

In total, 86% of Generation Z employees, 77% of Millennials, 57% of Generation X, and 41% of Baby Boomers are seeing their work performance deteriorate as a result of money-related stress.

These figures reveal an unavoidable link between money worries and work performance. Indeed, as Professor Cary Cooper said in The Workplace Today “How can anyone concentrate on work when they are anxious about money?”.

What’s staggering here is that it’s not just the younger generations who bring their money worries to work, even though they are the most likely to.

When rolling out financial wellbeing, you should ensure that your internal communications strategy caters to all generations. For example, you might find that younger generations – while most likely to experience money worries – are also most likely to feel open to discussing them. Conversely, older generations might struggle to talk openly about money.*

Want data around wellbeing? Here's much more |

|

How prepared are your staff if there's a recession? Our guide, cited by the CIPD, reveals how 1,300 UK workers are feeling about their finances. |

|

Download 'The Workplace Today'

|

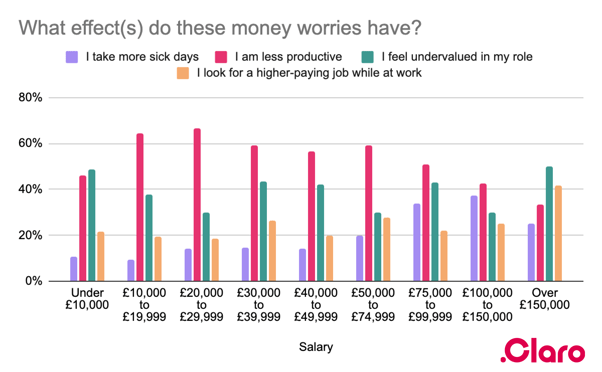

Unchecked money worries can turn into preventable sick days. Excluding the 'Over £150,000' group, our data reveal a correlation between size of paycheck and likelihood of taking a sick day due to money worries.

Meanwhile, most people on salaries between £10,000 and £150,000 find that money worries make them less productive.

When either of these outcomes happens, the result is time lost. Both are easily mitigated when a financial wellbeing strategy contains the right support.

For example, much like physical healthcare, financial health support should feature a mixture of preventative and reactive measures.

Through preventative measures (like educational courses, webinars and budgeting platforms), an organisation can create the conditions that make their employees less likely to experience worsening financial health.

And through reactive measures, an organisation can help its people solve specific financial problems that result from worsening financial health (for example, via financial coaching).

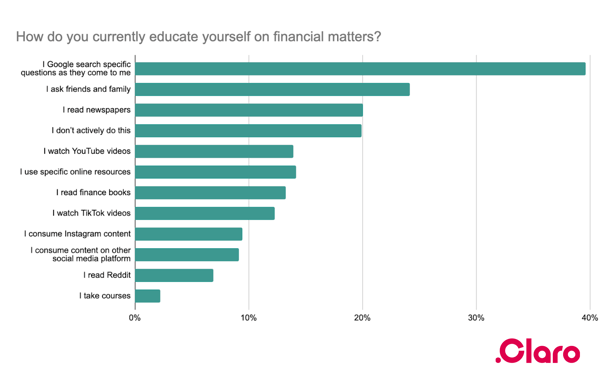

The most likely way an employee is to educate themselves about personal finances is to turn to Google – a preferred method shared by 40% of employees. Almost a quarter (24%) ask their friends and family for advice, while one in five (20%) read newspapers and 14% watch YouTube videos.

Over one in 10 (12%) rely on TikTok, while a similar percentage (13%) read finance books.

The responses indicate that there are many ways people like to consume content about personal finance. And this should be factored into plans when choosing how to deliver a financial wellbeing strategy.

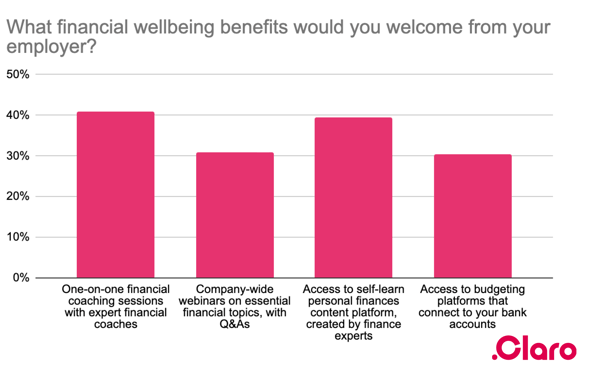

We asked employees what type of financial wellbeing support they'd prefer. No specific option stood out, with respondents tending to pick more than one.

On average, 41% of employees wanted one-to-one financial coaching, while 40% opted for a self-learn personal finances platform. Almost one in three (31%) were interested in webinars on financial topics. 30% found the idea of a budgeting platform appealing.

This supports the fact that an organisation’s financial wellbeing strategy should offer a mixture of different types of support.

If you don’t know what format of financial support would best suit your employees, you can ask them in a survey. We can even support you in managing the conversation internally to figure out the best mix of support.

*Our data in The Workplace Today supports this hypothesis: one-to-one financial coaching was more likely to be chosen by older generations, while group webinars were more likely to be chosen by younger generations.

6 min read

Blue Monday (15 January) has a mixed reputation. But there’s still value in using the day to raise awareness of mental health and wellbeing...

4 min read

Ever wished you had a money-whiz friend you could ask anything, as often as you like?

7 min read

Millions are being impacted by financial stress. Yet, until now, workers in frontline occupations have not been able to benefit from educational...