6 min read

Should employers acknowledge Blue Monday?

Blue Monday (15 January) has a mixed reputation. But there’s still value in using the day to raise awareness of mental health and wellbeing...

2 min read

Galina Stavskaya-Barengo, CFA

01-44-2023

Galina Stavskaya-Barengo, CFA

01-44-2023

Money makes the world go round. But many people lack the financial literacy skills needed to navigate the complex world of money management.

As a result, they miss out on valuable financial products such as savings, investments, insurance, banking products and pensions.

This is where financial wellbeing provider Claro Wellbeing comes in.

In this article, we explore the link between financial literacy and financial product uptake, and how partnering with Claro Wellbeing can benefit you.

Financial literacy is the knowledge and skills needed to make informed decisions about money management. It includes understanding financial concepts, such as interest rates, credit scores, and investing, as well as knowing how to use financial products and services effectively.

Unfortunately, many people lack these skills. Research has found that one in seven adults have literacy skills at or below those expected of a nine- to 11-year-old. The FCA’s Financial Lives Survey also found 17.7 million UK adults (34% of the total adult population) have poor or low levels of numeracy involving financial concepts.

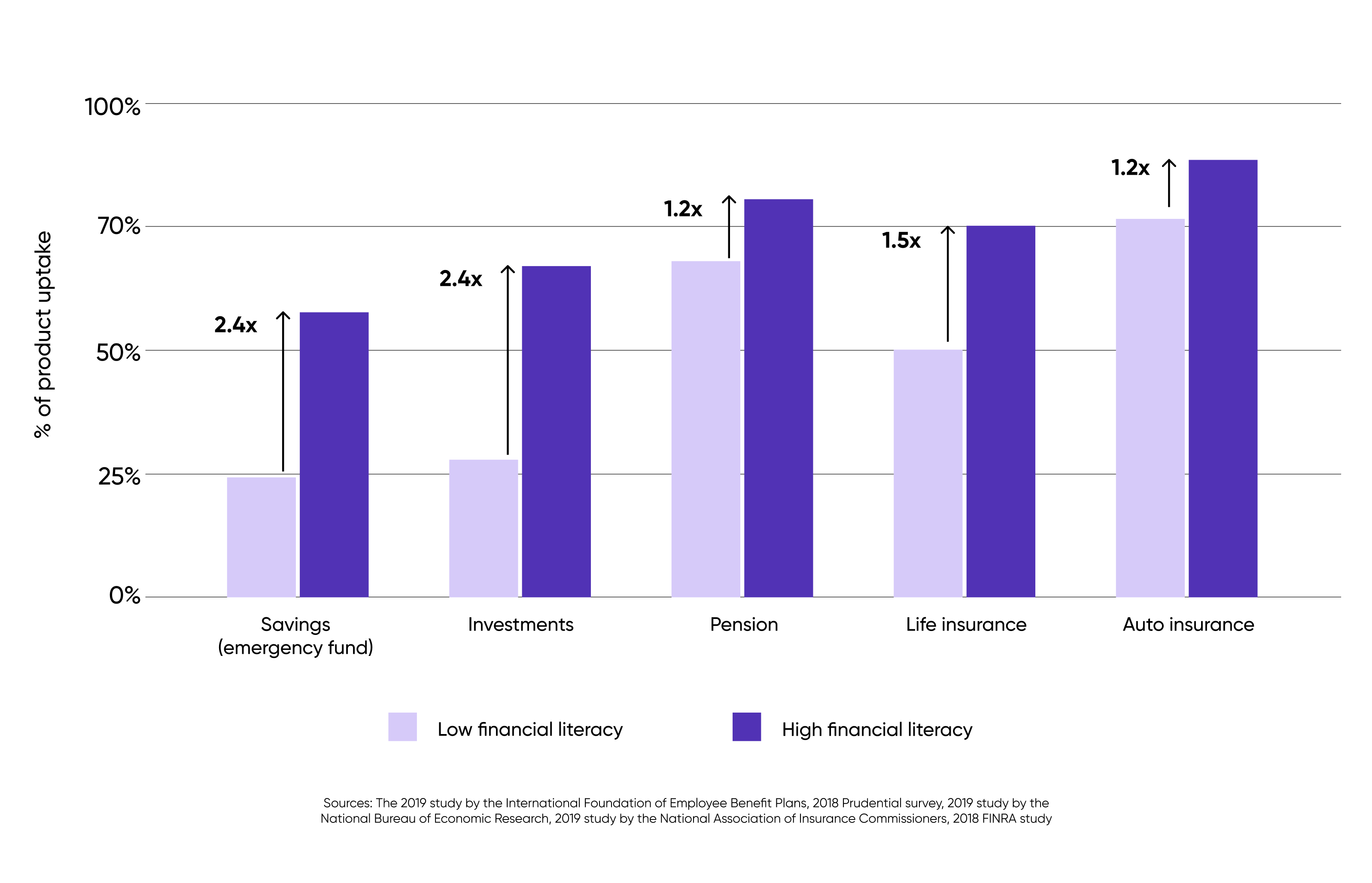

Low levels of financial literacy can have significant consequences on their financial wellbeing. According to recent studies, individuals with low levels of financial literacy are less likely to use products and services that better their financial wellbeing, than those with higher levels of financial literacy.

These findings show that financial literacy plays a critical role in the uptake of financial products and services.

Financial institutions that partner with Claro Wellbeing can help their customers improve their financial literacy levels and drive product uptake.

Claro Wellbeing is a financial wellbeing provider that offers financial education and coaching to help individuals improve their financial wellbeing.

Our programmes are designed to be engaging and interactive, making it easy for people to learn about complex financial concepts.

By partnering with Claro Wellbeing, financial institutions can offer their customers access to these programs, which can help them make informed decisions about financial products and services.

Partnering with Claro allows your company to tap into financial education, so you can

Financial literacy is a critical skill that can help individuals make informed decisions about money management. Unfortunately, many people lack these skills, leading to low uptake of financial products and services.

Financial institutions that partner with Claro Wellbeing can help customers improve their financial literacy levels, drive product uptake and increase engagement.

By doing so, they can empower their customers to make informed decisions about their finances, leading to better financial outcomes and improved financial lives.

|

Interested in becoming a partner?Arrange a call with Claro Wellbeing to discover how we can help you boost product uptake at your organisation. |

6 min read

Blue Monday (15 January) has a mixed reputation. But there’s still value in using the day to raise awareness of mental health and wellbeing...

4 min read

Ever wished you had a money-whiz friend you could ask anything, as often as you like?

7 min read

Millions are being impacted by financial stress. Yet, until now, workers in frontline occupations have not been able to benefit from educational...