6 min read

Should employers acknowledge Blue Monday?

Blue Monday (15 January) has a mixed reputation. But there’s still value in using the day to raise awareness of mental health and wellbeing...

4 min read

Oliver Gudgeon

11-27-2023

Oliver Gudgeon

11-27-2023

Shaping a strategy for financial wellbeing at work can be tricky. Particularly with the cost of living crisis persisting like an oceanic fog. How do you know whether you're doing enough to support your employees?

In this article, we’ll cover what employee financial wellbeing is, why it’s a win-win for employees and employers, and the best strategies to support your employees’ financial wellbeing.

The reality is, financial wellbeing in the workplace can take many different forms – from providing a basic pension to signposting to a mortgage broker to delivering a full financial education and coaching programmes and much, much more.

It’s easy to be overwhelmed when analysing the options. Let alone when actually choosing a provider. Pick the wrong one, and your best people end up with financial support they don’t use or value.

But with 69% of employees now saying their organisation should do more to support them, there's good reason to get your financial wellbeing strategy right.

There are many definitions of financial wellbeing. Just so we're clear on what we mean – at Claro Wellbeing, this is our definition:

Financial wellbeing is the state of feeling at peace and on track with one’s personal (or family) finances, as a result of having the financial education, experience and technology – as well as mindset – to navigate difficulties, meet obligations and achieve goals.

Financial wellbeing in the workplace aims to alleviate money worries, reduce financial stress and improve financial resilience. So that all employees – including those facing financial stress and mental health problems – feel happy about their financial future.

Many HR departments in organisations see financial wellbeing as one of the three pillars of employee wellbeing. The other two are physical and mental wellbeing.

According to Forbes, organisations that invest in their people’s wellbeing typically see stronger performance than those that don’t.

A successful financial wellbeing strategy is a win-win for an organisation and its people, offering four main benefits:

Make your people more likely to stay. Studies show 1 in 5 employees will look for a new, higher-paying job in the next 12 months if the cost of living crisis worsens.

Increase employee productivity. Our recent report found money worries are impacting as many as 67% of employees while at work, making them less productive, more likely to take sick days, and more likely to feel undervalued.

Attract new employees and improve your employer brand. An overwhelming 81% of employees say a financial wellbeing programme would increase their satisfaction at work.

Help your employees live their best lives. The less financially stressed your employees feel, the better their wellbeing will be – both inside and outside the workplace.

Keep in mind that financial wellbeing strategies that focus on education can unlock value from an organisation’s existing benefits. For instance, following Claro Wellbeing’s Finance Friday sessions, we have seen an increase in enrolment in our pensions programme.

There are many types of financial support available to employees. These are the most common ones:

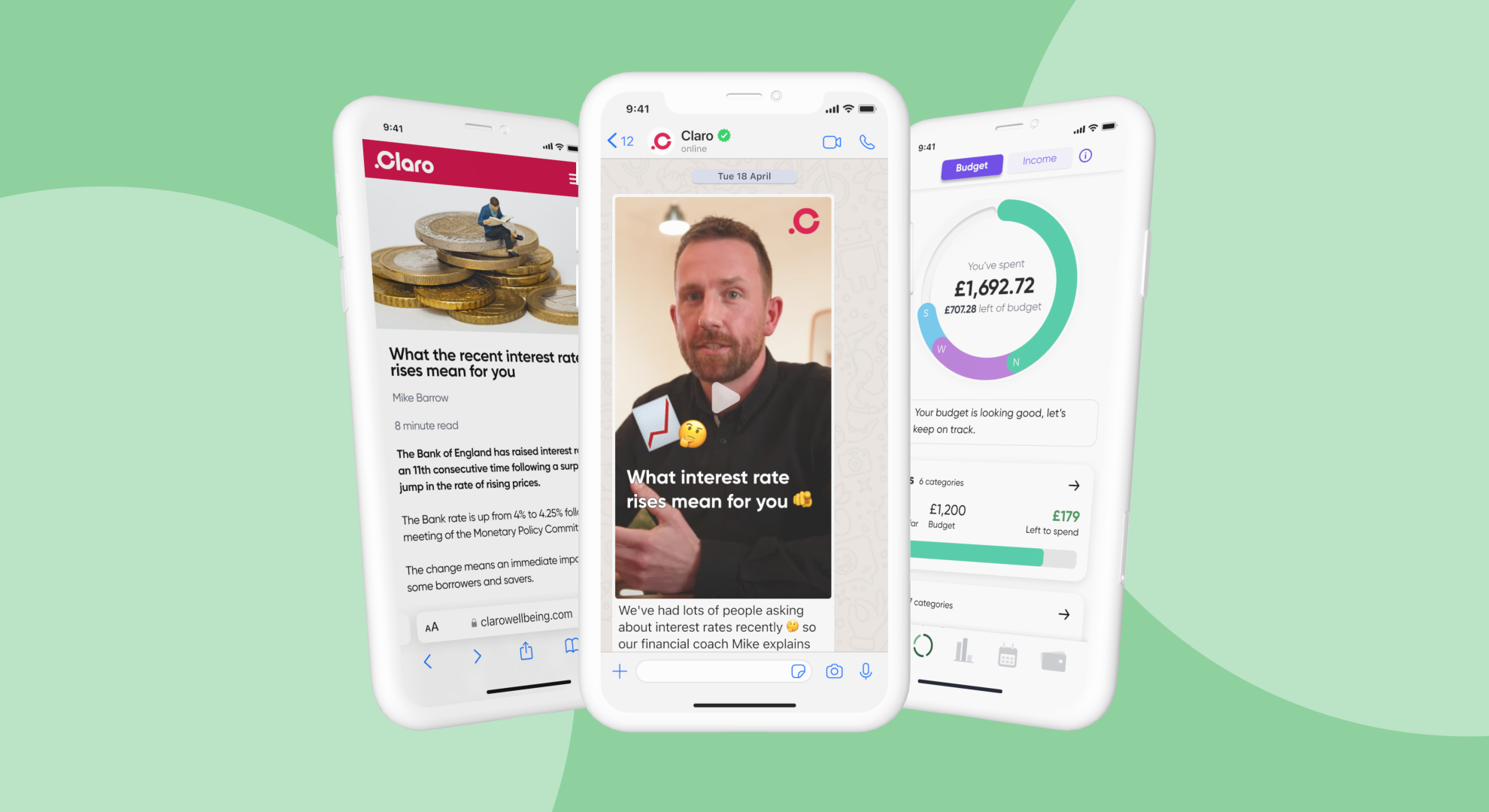

The best kinds of financial wellbeing strategies are often those that put financial education and guidance first. According to former CIPD president Professor Cary Cooper, this must also include a one-to-one service.

This is because financial wellbeing involves a great deal of one understanding their own financial circumstances, decisions and options – then, creating a plan of action.

Levels of financial literacy are also generally very low in the UK, despite the country being the sixth-largest economy in the world.

Financial education is not generally taught at school. Many of us learn about finance from personal experience, but only after we leave school.

While there’s no one-size-fits-all approach to shaping a financial wellbeing strategy, there are different options to understand.

A financial wellbeing strategy is at its most effective when it addresses the challenges and problems that your employees actually face. In what aspects of personal finance do your employees experience the most frustration, confusion or hardship?

Asking them about their mid- and long-term financial goals as well as immediate financial obstacles can help you really get a sense of where they are with their financial situation. It’s also good to understand their mindset, levels of financial literacy and general mental wellbeing.

The best way to do this is by carrying out an internal survey or assessment. Or work with a financial wellbeing provider like Claro Wellbeing to help conduct an assessment according to our established criteria.

The financial wellbeing provider market is very much an emerging market right now. Making heads or tails of it can be hard.

As a minimum, you should have the following covered in your financial wellbeing strategy:

Once you’ve selected your financial wellbeing provider, it’s time to introduce them to your team.

There are a number of ways to do this, such as holding an introductory webinar or making available a set of one-to-one coaching sessions. However, the exact way will depend on your organisation and how your people prefer to communicate.

Whatever you decide, remember this should be a gentle way to ease your people into your financial wellbeing programme, while also introducing them to your chosen provider.

There are many ways to measure the ROI of financial wellbeing. These depend, ultimately, on the goals your organisation is trying to achieve within its wider HR and talent management strategy.

We recommend you review your financial wellbeing strategy metrics on a quarterly basis to see whether it is helping your organisation meet its goals.

If you need extra support with this, you can use Claro Wellbeing’s platform to track specific data points – like employee financial health scores and adoption rates.

Get our data-packed report on financial wellbeing |

|

|

UK employees are each spending an average of three-and-a-half days per year on personal finance tasks while at work. But, as our nationally representative survey of more than 1,300 employees reveals, the true cost of poor financial health is potentially much greater. Download 'The Workplace Today'

|

6 min read

Blue Monday (15 January) has a mixed reputation. But there’s still value in using the day to raise awareness of mental health and wellbeing...

4 min read

Ever wished you had a money-whiz friend you could ask anything, as often as you like?

7 min read

Millions are being impacted by financial stress. Yet, until now, workers in frontline occupations have not been able to benefit from educational...