6 min read

Should employers acknowledge Blue Monday?

Blue Monday (15 January) has a mixed reputation. But there’s still value in using the day to raise awareness of mental health and wellbeing...

4 min read

Oliver Gudgeon

16-49-2023

Oliver Gudgeon

16-49-2023

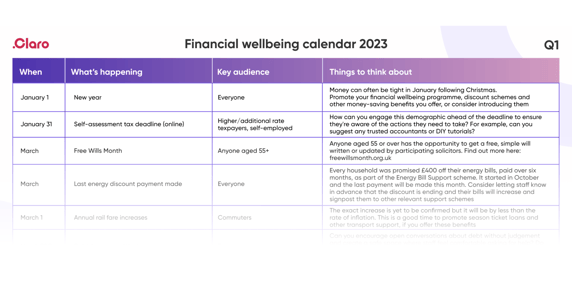

One important thing to consider when you’re planning financial wellbeing activities – like webinars and workshops – is how they align with key dates in the financial calendar.

For many, personal finance can feel pretty unpredictable. Especially now. But there are, nonetheless, well-worn grooves shaped by predictable, recurring personal finance dates that guide us throughout the year.

These determine what many of us are likely thinking at any given time.

That’s why having a sense of when and what those key dates are – and how to plan around them – is essential for every HR, benefits or wellbeing team.

In this article, we’ll explain the benefits of ensuring some of your financial wellbeing activities align with key dates in the financial calendar (and the risk of not doing so). We’ve also identified the top seven personal finance dates you should pay attention to.

There are two main benefits to syncing your financial wellbeing activities to key personal finance dates.

1. It boosts your employee engagement

Ensuring your financial wellbeing initiatives align with key personal finance dates that impact your staff, will mean people are more likely to engage with your activities.

This is because it will help you position your activities as helpful reminders or headstarts on challenges your employees would have had to tackle anyway. You’re essentially helping them bring back-of-mind stresses front of mind, so they can be tackled head-on.

2. It shows you care and understand your employees

Planning financial wellbeing activities around timely topics show employees you care, because they signal that you understand the obstacles they face. You’re not only aware of their challenges, but you are offering support to help them overcome them.

On the flip side, if you plan financial wellbeing activities that are totally out of sync with the financial calendar, you risk coming across as financially tone-deaf. For example, planning a how to keep your energy bills down webinar in July.

Early January: annual train fare hike

Those who commute to work by train or tube will see the cost of getting to work increase. So, it’s a good idea to bear this in mind. This usually happens in January, although in 2023 the hike was delayed until March.

If you have any travel-related benefits, like seasonal ticket loans or travel subsidies, it’s the perfect time to remind them what they have available.

You can also introduce financial topics that help tackle the consequences of higher commuting costs. For example, by giving them access to webinars and workshops around budgeting for success, or access to rewards and discounts schemes that help them reduce their daily expenses.

31 January: self-assessment tax deadline

The number of people registered as self-employed skyrocketed during the pandemic and now sits at 4.3 million, a significant portion of the UK’s working population.

For the side-hustlers and landlords among your employees, the festive season is followed immediately by a self-assessment tax return and bill. This can be a little daunting, especially if December has been expensive. (Some 3,275 people even submitted theirs on Christmas Day, according to HMRC.)

So it’s worth bearing in mind that, on top of the post-holiday blues, employees may be feeling stressed about completing their return and the bill they have to pay.

This doesn’t stop you from planning any initiatives in January each year. But it is worth bearing in mind that those who have yet to submit their returns may still be stressed about hitting the deadline.

Rather than bring up new webinar topics to teach your employees, giving them headspace and time to focus on tasks relating to this can be immensely valuable. For instance, at Claro Wellbeing, we run Finance Fridays – a workshop during which you independently tackle personal finance tasks, while connected to everyone over a video call.

This means those with tax returns on their mind can sort out a couple of the tasks associated with it. It also enables those who are not submitting a tax return to take a look at things like their new year budgeting and money management.

Mid-March: Spring Budget

Twice a year, the UK government outlines new economic measures and changes it plans to introduce. These usually have an effect on each of our personal finances.

Giving your people a breakdown of the key changes and what they mean is a great way to help your employees understand what changes (if any) they need to make to things like their spending, saving and investing.

Will they be paying more income tax? Can they expect their energy bills to increase? Are measures going to be introduced to help first-time buyers?

6 April: start of the new tax year

The start of the new tax year means many things to many people.

For the savers among your employees, it means a fresh ISA allowance, and possibly even a fresh ISA to pay into.

Choosing an ISA can be a tough choice – should you get a cash ISA, Lifetime ISA or stocks and shares ISA?

So, April can be a great time of year to offer those unhappy with their current method of saving valuable information on the different options open to them.

The new tax year usually means rises in bills. For example: council tax, water, broadband, prescriptions.

So, it’s another good moment to put on activities on topics like daily spending and managing money.

Early September: new academic year

With the kids heading back to school – and thoughts swirling around their children’s futures – early September is a great time of year to help parents (and those preparing to become parents) with a bit of family planning.

Consider running events around topics on everything from managing monthly family budgets, to saving for their child’s future, to the unavoidably morbid topic of wills and estate planning.

Giving access to on-demand financial courses and content is a great way to educate your employees about setting their families up for success in the future.

Mid-November: Autumn Budget

Just like the Spring Budget, the Autumn Budget – usually held in November – may result in your employees having to think about their personal finances. It can be a time of anxiety and stress, and mean grappling with hard-to-digest detail.

Late November: Black Friday, Cyber Monday and the run-up to Christmas

A recent study by StepChange, a debt charity – published in the BBC – found that one in three people are not sure how they’ll pay off the debt racked up on credit cards over Christmas.

It can be a challenging time of year and one at which we are more likely to overspend. So it’s important to keep in mind the money worries your employees might be going through, while under pressure to pay for Christmas.

It’s a good idea to offer your employees educational resources at the start of the season, to help them understand the dos and don’ts of credit cards, managing debt, and how to keep emotional spending under control.

In doing so, it’s important to avoid using language that could come across as patronising, or even judgemental.

To sum up:

It’s important to plan financial wellbeing some activities around key finance dates. This helps you:

In the UK, there are seven key dates, in particular, to pay attention to:

Always keep your financial wellbeing activities relevant |

|

|

Get our financial wellbeing calendar and never miss an important financial date.

|

6 min read

Blue Monday (15 January) has a mixed reputation. But there’s still value in using the day to raise awareness of mental health and wellbeing...

4 min read

Ever wished you had a money-whiz friend you could ask anything, as often as you like?

7 min read

Millions are being impacted by financial stress. Yet, until now, workers in frontline occupations have not been able to benefit from educational...