6 min read

Should employers acknowledge Blue Monday?

Blue Monday (15 January) has a mixed reputation. But there’s still value in using the day to raise awareness of mental health and wellbeing...

2 min read

Oliver Gudgeon

07-35-2023

Oliver Gudgeon

07-35-2023

If you’re researching financial wellbeing providers, try Claro Wellbeing’s platform free for 14 days and discover how you can boost your people’s financial health in 2023.

Update: November 2023A new, improved 14-day free trial of Claro Wellbeing is available. Find out more and access it here. |

These disorienting economic times have seen financial stress increase dramatically. Only 27% of UK adults feel in control and happy when it comes to their finances. The rest feel concerned – if not unhappy, stressed or overwhelmed.

Organisations now need to do more to support their employee's financial wellbeing.

So, we’re launching a free 14-day trial of Claro Wellbeing, to help you assess the best way to support your employees and transform your organisation’s financial wellbeing strategy.

|

Try Claro WellbeingNo credit card is required to activate your trial. Simply sign up and get started.

Start your free trial

|

The platform trial includes access to many top features, including our comprehensive online financial courses, budgeting tool, financial health quiz and expert insights written and recorded by our expert financial coaches.

So, if you’re planning your financial wellbeing strategy for 2023, give Claro Wellbeing a try and see what our platform can do for your people’s financial health.

.png?width=1268&height=869&name=Frame%209600%20(1).png)

Take our financial health quiz and find out your current level of financial health and resilience.

It only takes a few minutes to complete. And you can retake it whenever you like to check in on your progress.

You can also see a scale of how you compare to average levels of financial health.

Claro Wellbeing’s personal finance courses cover everything you need to improve your financial knowledge, so that you can, in turn, give your financial health a boost.

The platform houses tens of expert-made courses created by our in-house, certified financial coaches, who’ve helped thousands of people take control of their money.

Available in both written and video form, the courses cover everything from building financial resilience to saving more money to buying your first property (and much more).

Each employee has different financial goals and challenges, which is why we’ve designed our course to support everybody – from new graduates to those approaching retirement.

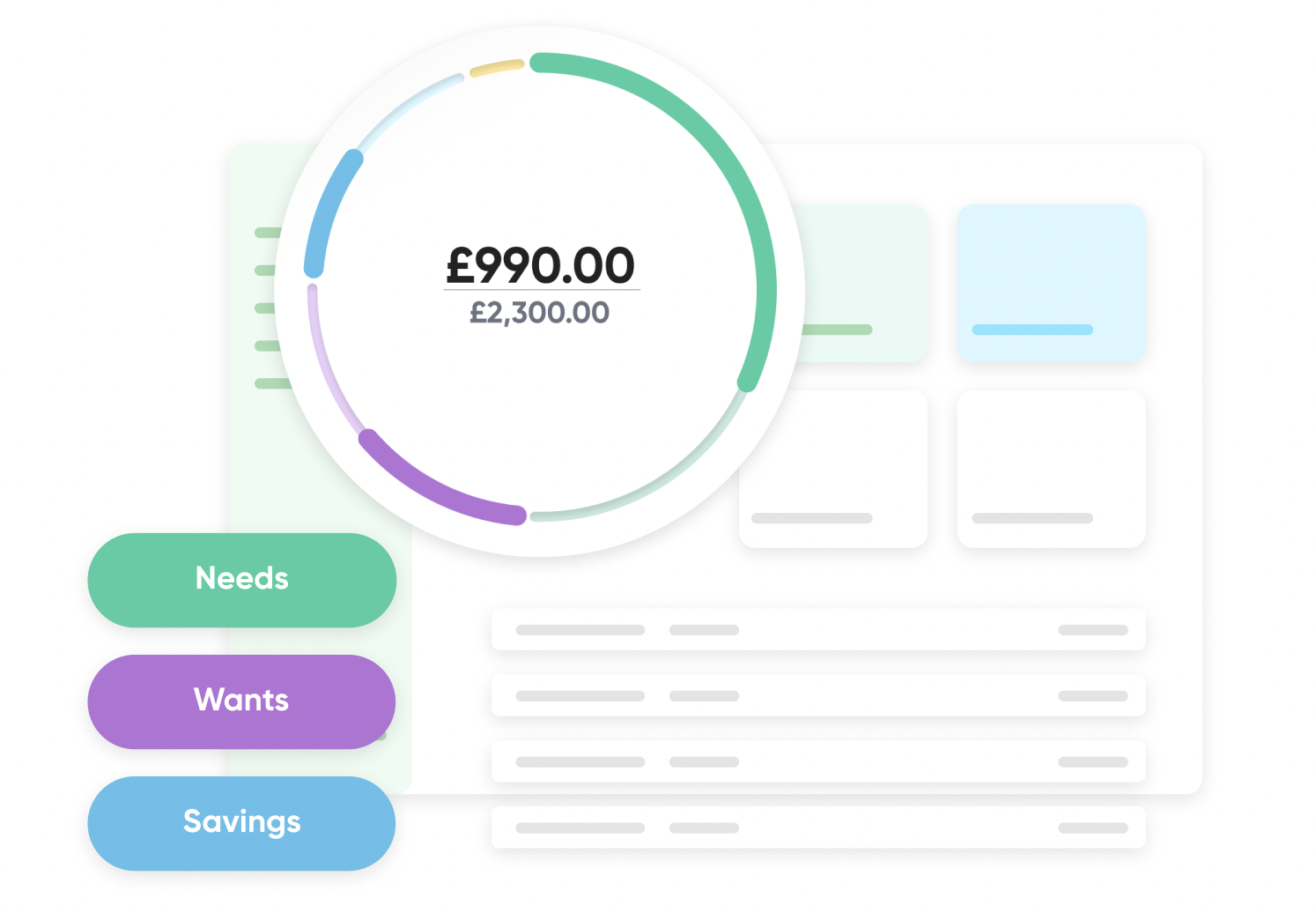

If you have multiple bank and credit cards, you can use the open-banking-enabled budgeting tool to see all your spending in one place – but that’s just the start.

The tool is packed with features to help you keep on track with your spending each month.

The tool also breaks down how much money has gone towards your needs (that is, your life essentials, like rent, bills and groceries), your wants (that is, your spending for leisure, like outings and subscriptions) and your savings.

The Claro Wellbeing platform provides you with a library of short-reads and webinars, so that you can always keep your personal finance knowledge up-to-date.

The articles and webinars are made out of expert knowledge from our certified financial coaches, with new content being added every week.

Get started with your free 14-day trial now and see how you can start boosting your people’s financial health.

You're at your best whenthey're at theirs |

|

|

Start your free 14-day trial of Claro Wellbeing and discover how you can move your organisation forwards in 2023. Try for free |

6 min read

Blue Monday (15 January) has a mixed reputation. But there’s still value in using the day to raise awareness of mental health and wellbeing...

4 min read

Ever wished you had a money-whiz friend you could ask anything, as often as you like?

7 min read

Millions are being impacted by financial stress. Yet, until now, workers in frontline occupations have not been able to benefit from educational...