6 min read

Should employers acknowledge Blue Monday?

Blue Monday (15 January) has a mixed reputation. But there’s still value in using the day to raise awareness of mental health and wellbeing...

If you’re implementing a financial wellbeing strategy and want to measure the value it brings to your organisation, this article is for you. You’ll learn about the return on investment (ROI) of financial wellbeing: what it means and how to measure it.

Measuring ROI is notoriously tricky, but – in the current economic climate – absolutely critical.

Let's dive in.

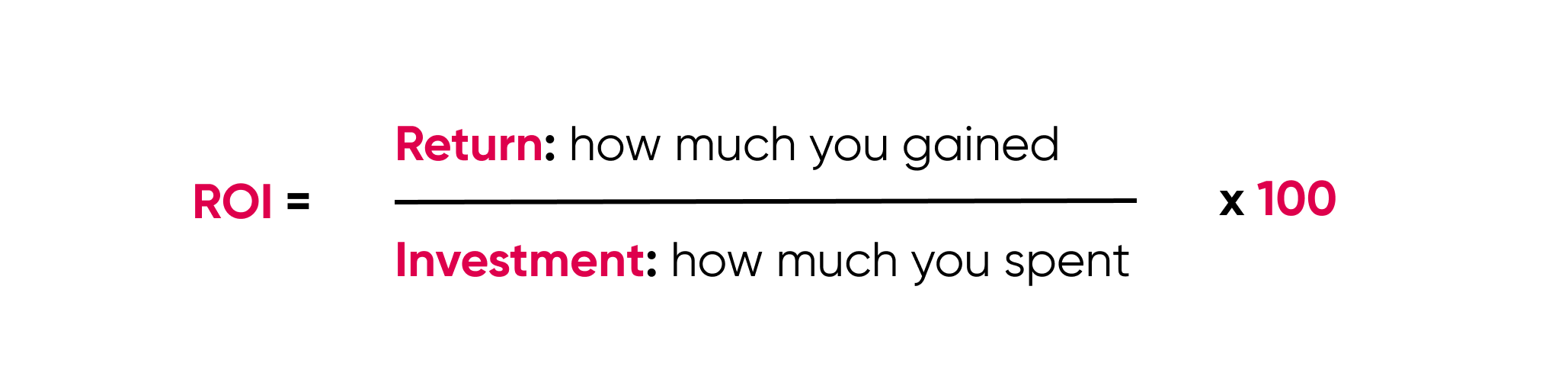

ROI is the value (return) gained from any business activity, divided by its spend (investment). Multiplying the division by 100 gives you an ROI as a percentage.

You can work out the ROI of anything by calculating:

For example, say you spent £2,500 per month on a financial wellbeing strategy, but it created an equivalent of £15,000 per month in days regained from poor productivity and employee absences along with recruitment costs, you’d have an ROI of 600% (15,000/2,500 x 100 = 600).

Because the return should be greater than the investment, you’ll want an ROI that is greater than 100%. The higher the ROI percentage, the better.

For financial wellbeing strategies, ROI can be challenging to quantify. This is because financial wellbeing usually forms part of a wider employee assistance programme (EAP).

For instance, you might prefer to report the ROI of your entire EAP, including mental wellbeing and physical wellbeing. If that's the case for you, we'd still encourage you to keep reading. Because, either way, you'll still need to work out how well your financial wellbeing strategy is supporting your EAP.

To calculate the ROI of financial wellbeing, you need to be clear on your overall strategic goals.

Here are some typical goal examples.

Tip: you should compare the before and after of your overall strategic goals, when you implement a new financial wellbeing strategy or adjust your existing one.

1. Calculate what your organisation gains

|

What you gain |

How to measure it |

Why you should measure it |

|

|

Retention |

Reduced employee attrition |

(Number of employees who left during time period ÷ total number of employees) X 100 |

You can’t prevent employees from leaving. But you can improve an employee’s chances of achieving their life goals and indicate you care about their wellbeing, making them less worried about money and more likely to stay. |

|

Recruitment & employer brand |

Increased candidate interviews booked |

Total number of candidates booked for interview that meet company requirement |

Financial wellbeing benefits help attract a greater share of good candidates. |

|

Increased offer acceptance rate |

(Number of offers accepted ÷ total number of offers made) x 100 |

Financial wellbeing programmes are attractive to offer. But you need this to translate to improved recruitment conversions. |

|

|

Improved quality of hires |

Average time to reach shortlist per role. Percentage of hires who make it through their probationary period. |

How long does it take until you’ve received enough candidates for new roles to begin shortlisting them? And what percentage of those you hire make it through probation? |

|

|

Increased number of employee referrals |

Percentage of hires that are employee referrals. |

Employee referrals should make up 30 – 40% of hires, according to Zippia. If employees are willing to take the social risk of recommending your organisation, they’re likely to think well of it themselves. |

|

|

Productivity |

Improved employee performance |

Establish feedback channels with line managers: are those they manage meeting expectations? Are regular performance reviews/ratings adequate or improving? |

67% of employees with money worries say it affects their work. Reducing money worries enables an organisation to improve overall employee wellbeing. |

|

Culture |

Improved employee performance |

Establish feedback channels with team managers: are teams meeting expected outcomes? |

Quality of work is generally higher when an organisation’s culture is good and employees are mentally healthy. |

|

Improved company culture |

Conduct organisation-wide surveys to gather employee feedback on company culture and company leadership. |

A strong culture makes your company’s overall strategy more effective, according to HBR. |

To make your ROI calculation, create a table like the one above. Which are the most important gains your organisation wants to make?

Try to keep the high-level picture of your strategy to one single page. This will help you be clear and structured in your thinking.

As part of this process, it's good to think about:

Once you have everything down in a document, it's time to add one more column where you attach a £ value to each goal. How much does doing nothing in each strategic goal cost your organisation?

Finally, add up your total return for your organisation.

2. Calculate what your employees gain

|

Return |

How you can measure this |

Why you should measure this |

|

|

Financial health |

Improved financial health

|

Use a platform that tests individuals for their financial health scores, which can also aggregate employee financial health score data to show average financial health scores over time. You can do this via Claro Wellbeing’s built-in analytics. |

Measuring your employees’ financial health scores indicates whether – and by how much – your financial wellbeing strategy is benefitting your employees. It helps you confirm whether it is boosting employee financial health. |

|

Mental wellbeing |

Improved mental wellbeing

|

Run regular, anonymous internal surveys to track mental wellbeing, and review them. |

Looking after your employees’ wellbeing can boost productivity by 12%, according to the Mental Health Foundation. |

|

Work performance & employee satisfaction |

Improved work performance |

Get feedback from line managers: are employees maintaining high-quality work output? Analyse performance ratings/reviews of employees. |

Work performance is important to employees, not just organisations. And often closely linked to financial health. So, it’s critical to help remove obstacles to employees’ financial health, so they can do their best work. |

|

Improved employee satisfaction |

Get feedback by running anonymous internal surveys, and/or from line managers: are employees feeling supported in their roles? |

The availability of a financial wellbeing can help employees feel that their wellbeing is supported by their employer – even if they do not use it. Our recent survey of more than 1,300 UK workers found that employees who think their employers care about their personal finances are 7x more likely to be extremely satisfied than those who are deeply unsatisfied. |

Just as you did for your organisation's goals in the previous table, put a £ value on each of your strategic goals for employees. Then add them up.

You now have your total return for both your organisation and its employees. Note, you might want to keep the two separate for your calculation, so that the difference between the two is clear.

3. Calculate your total investment

Now that you've calculated the returns that both your organisation and your employees get from financial wellbeing, it's time to add up your investment.

To work this out, you'll need to consider how much you are currently spending on any platform subscriptions or providers that make it possible for you to calculate your financial wellbeing benefit.

If you don't have any platform subscriptions or providers, you'll need to conduct research and, ideally, get actual quotes to understand how pricing works and what your spend could be.

4. Make your ROI calculation

You're ready to divide each of your organisation's and employees' gains by your total investment and multiply each answer by 100.

That's it – you have your ROI calculation!

If you're just looking for a quick calculation of the ROI, you can try our financial wellbeing ROI calculator. It'll give you a snapshot of how much financial wellbeing strategy could save your organisation and employees, based on data including from the Office for National Statistics (ONS).

You can set it to match your average employee salary, average employee age and number of employees.

You'll be shown how much poor financial wellbeing could be costing each of your employees right now, along with the number of hours you could save your organisation and much more.

When measuring your financial wellbeing strategy’s ROI, you can take the extra step of measuring activity-based metrics.

Activity-based metrics are markers that are tied to individual activities that you carry out. Typical examples include one-to-one financial coaching sessions and financial education workshops.

Measuring activity-based metrics will help you identify how the specific employee benefits packages you’ve chosen to include in your financial wellbeing strategy are contributing to your overall strategic goals.

You don't have to include these as part of your overall calculation. But if you plan to calculate your ROI infrequently or on an ad-hoc basis, activity-based goals are essential to monitor.

For example, here are some of the most basic types of activity-based goals to consider as part of a financial wellbeing strategy.

Claro Wellbeing’s platform makes it easy to track aggregated usage statistics, so you know if your people are actually getting value out of their financial wellbeing platform.

Here are some things we'd recommend you track.

|

Activity |

Metric |

What to measure |

|

Overall use of financial wellbeing benefit: adoption rate |

Improved financial knowledge and confidence |

|

|

One-to-one financial coaching sessions |

Improved financial knowledge and confidence |

|

|

Group workshops and webinars |

Improved financial knowledge and confidence |

|

|

Budgeting |

Improved financial mindset, knowledge and planning skills |

|

|

Online learning and courses |

Improved financial knowledge and confidence |

|

We can also work with you to measure any specific metrics that are important to your strategy.

Note, it’s impossible for an employer to use Claro Wellbeing to see how individual employees are using it. You can only see aggregated views of data, so employee privacy is always protected.

Calculating the ROI of financial wellbeing doesn't have to be difficult. Hopefully, this guide has helped you get closer to finalising your strategy.

Use the financial wellbeing ROI calculator |

|

|

Calculate how much you could be saving your organisation and its people with a financial wellbeing programme. |

6 min read

Blue Monday (15 January) has a mixed reputation. But there’s still value in using the day to raise awareness of mental health and wellbeing...

4 min read

Ever wished you had a money-whiz friend you could ask anything, as often as you like?

7 min read

Millions are being impacted by financial stress. Yet, until now, workers in frontline occupations have not been able to benefit from educational...