6 min read

Should employers acknowledge Blue Monday?

Blue Monday (15 January) has a mixed reputation. But there’s still value in using the day to raise awareness of mental health and wellbeing...

2 min read

Amelia Murray

16-8-2022

Financial wellbeing has been a priority for the most progressive businesses for some time and as the cost of living crisis rolls on, has found its way to the top of many companies’ agendas.

But HR teams are still learning how best to deliver an effective financial wellbeing strategy that serves the needs of the entire workforce - one that is inclusive and non-exclusive.

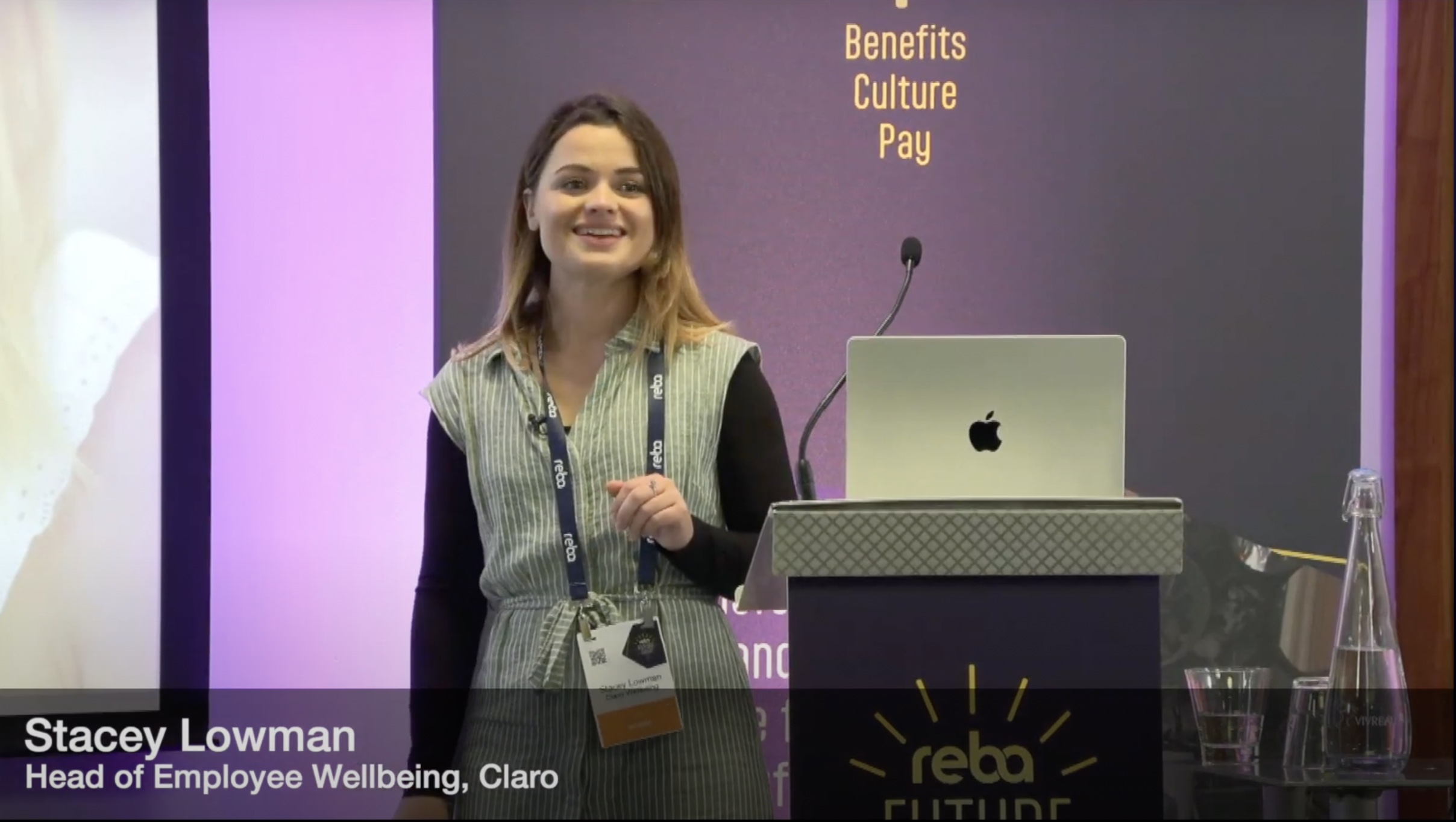

Stacey Lowman, Head of Employee Wellbeing and a financial coach at Claro Wellbeing, discussed this topic at Reba’s Future Forum last month in an engaging and interactive keynote speech.

She challenged the financial assumptions we make about different groups of employees and addressed how an inclusive financial wellbeing programme can also support wider Environmental, Social and Corporate Governance (ESG) initiatives.

In a live poll, Stacey discovered the biggest challenge faced by organisations when creating a financial wellbeing programme is understanding the needs and requirements of employees, with 36% choosing this answer. Could this reflect the thoughts of you and your HR team?

If so, getting the foundations right is crucial. And don’t worry about trying things out - as Stacey rightfully points out, delivering an effective and inclusive financial wellbeing programme is new to employers and employees alike - we’re all learning together.

Business leaders may have to make themselves vulnerable by asking their staff questions, listening to their answers and potentially opening themselves up to scrutiny, engaging their cynics and challenging their own bias. They may also have to start from scratch in creating safe spaces where conversations around money are welcomed.

But in order to provide a meaningful programme that serves your workforces’ needs and genuinely makes a difference, these activities are worth exploring.

Not only can a financial wellbeing programme reduce financial stress in the workplace and boost productivity, decrease sickness absence and improve retention while attracting top talent, but it could also help support your wider ESG initiatives and progress towards Sustainable Development Goals.

For example, it could include education on sustainable spending, investing and pensions, and discounts and other financial incentives in exchange for environmental action.

For social, a financial wellbeing strategy would improve financial literacy across the company and could provide an opportunity for community building and how staff can support each other, and for corporate governance it could help promote transparency around pay reviews and the gender pay gap.

Stacey’s talk went down a storm at the Reba event and clearly resonated with attendees, sparking a number of conversations around the topic.

Jake Attfield, programme manager at not-for-profit campaign group Fair4All Finance, said: 'Highlight of the day for me was Stacey Lowman from Claro Wellbeing who gave a really insightful thought piece on developing an authentic financial wellbeing strategy that meets your business goals and aligns to the #sdgs.’

If you don’t believe us, watch Stacey’s talk for yourself.

6 min read

Blue Monday (15 January) has a mixed reputation. But there’s still value in using the day to raise awareness of mental health and wellbeing...

4 min read

Ever wished you had a money-whiz friend you could ask anything, as often as you like?

7 min read

Millions are being impacted by financial stress. Yet, until now, workers in frontline occupations have not been able to benefit from educational...